THE CORONAVIRUS PANDEMIC is unsurprisingly sending projections for tech markets downward, according to recent surveys from market research firms IDC and Quocirca—but both find some hopeful signs as well.

According to IDC’s Worldwide Quarterly Server Tracker and Worldwide Quarterly Enterprise Storage Systems (ESS) Tracker, under the current probable scenario (as of March 26) server market revenue will decline 3.4% year over year to $88.6 billion, and ESS revenue will drop 5.5% to $28.7 billion in 2020. However, while both servers and ESS are predicted to drop 11% and 7.3% in Q1, respectively, IDC expects a return to growth for servers and slight growth for ESS in the second half of the year.

The server revenue decline is not as steep as the ESS market’s dip because it is being offset by increasing demand from cloud service providers, according to IDC. Longer term, IDC expects a compound annual growth rate of 4.9% over the next five years for the server market and 1.3% CAGR for the ESS market.

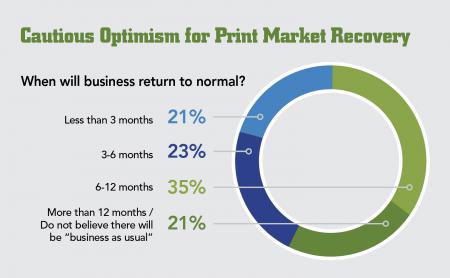

Similarly, Quocirca research conducted between March 31 and April 7 finds print industry professionals worldwide are experiencing market disruption, with 66% stating that the crisis has had a significant impact on business, and 3% saying that impact has been critical.

As in the server market, two opposing forces are affecting print volumes. While 70% of respondents are seeing or expecting significant decline in print volumes overall, 47% are seeing increased demand from healthcare customers and 28% are seeing increased demand in government organizations.

Meanwhile, 61% of channel respondents are seeking extended/flexible payment terms from suppliers, and 55% say they need more information on supply chain updates. In addition, 38% are predicting a drop in demand for managed print services.

There is some upside: 21% of respondents see general opportunities for their business and 79% say there could be a chance to drive product and service innovations.

Image: iStock