The MSP market is experiencing significant consolidation. Larger MSPs are acquiring smaller firms to expand their reach and capabilities. This trend is driven by the increasing complexity of IT systems, talent shortages, and a growing demand for specialized services. It’s also being fueled by private equity (PE) firms pursuing roll-up strategies.

As businesses consolidate, it presents sellers with significant opportunities for attractive outcomes.

What Private Equity Looks for in MSP Investments

Here are seven key MSP investment trends drawing attention from private equity.

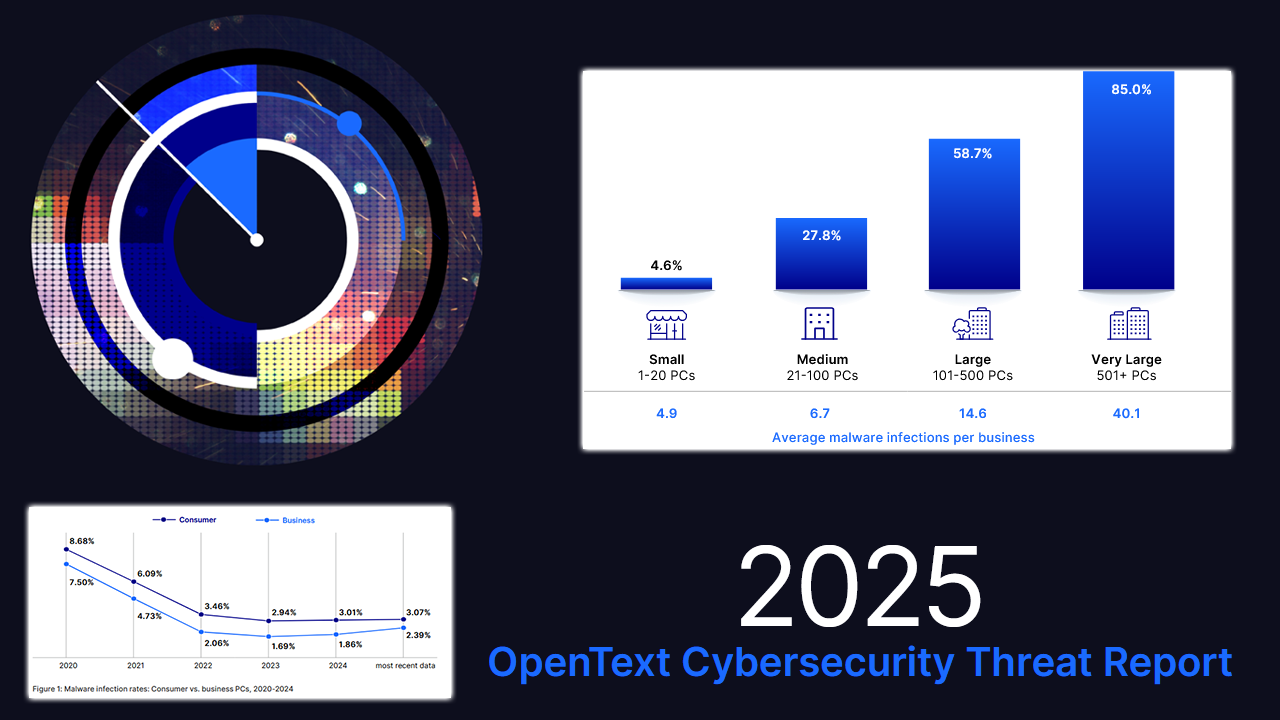

1. Cybersecurity MSPs

Cybersecurity is a top priority for businesses, and PE firms are investing in MSPs that offer managed security services. As cyber threats grow more sophisticated and regulatory requirements increase, there’s more demand for outsourced security solutions. PE investors are especially attracted to MSPs specializing in areas like threat detection, incident response, and compliance management. Focusing on strong cybersecurity practices, including AI-driven threat mitigation, enhances their investment potential.

2. Mobile Device and TEM

With the rise of remote work and mobile-first strategies, managing mobile devices and telecom expenses is critical. PE investors are increasingly targeting MSPs that provide mobile device management (MDM) and telecom expense management (TEM) systems. These services help businesses control costs, secure mobile infrastructure, and ensure regulatory compliance. MSPs with proprietary platforms or partnerships with leading mobile technology vendors are particularly attractive to PE firms looking to invest in the fast-growing mobility management space.

3. Application Management and Cloud Services

As businesses migrate to cloud environments, MSPs offering comprehensive application management services are in high demand. PE firms are drawn to MSPs that provide cloud migration, performance monitoring, and ongoing maintenance. MSPs focusing on cloud-native infrastructure like DevOps and containerization are of particular interest to investors. The shift to cloud-based applications will fuel growth in this area.

4. Telecom and Network Management

Telecom and network management services are essential for businesses expanding their digital infrastructure. From unified communications and VoIP systems to SD-WAN, MSPs that offer end-to-end telecom and network systems are crucial for businesses looking to scale efficiently. PE investors value MSPs with a strong focus on network security and performance optimization.

5. Vertical Specialization

An emerging trend in PE investment is MSPs with vertical specialization. Investors are attracted to these MSPs that offer tailored services to specific industries, such as healthcare or finance. Vertical specialization allows MSPs to build deep expertise in industry-specific regulations and technology needs. Service providers with strong industry relationships and proven track records in high-growth sectors are prime targets for PE firms.

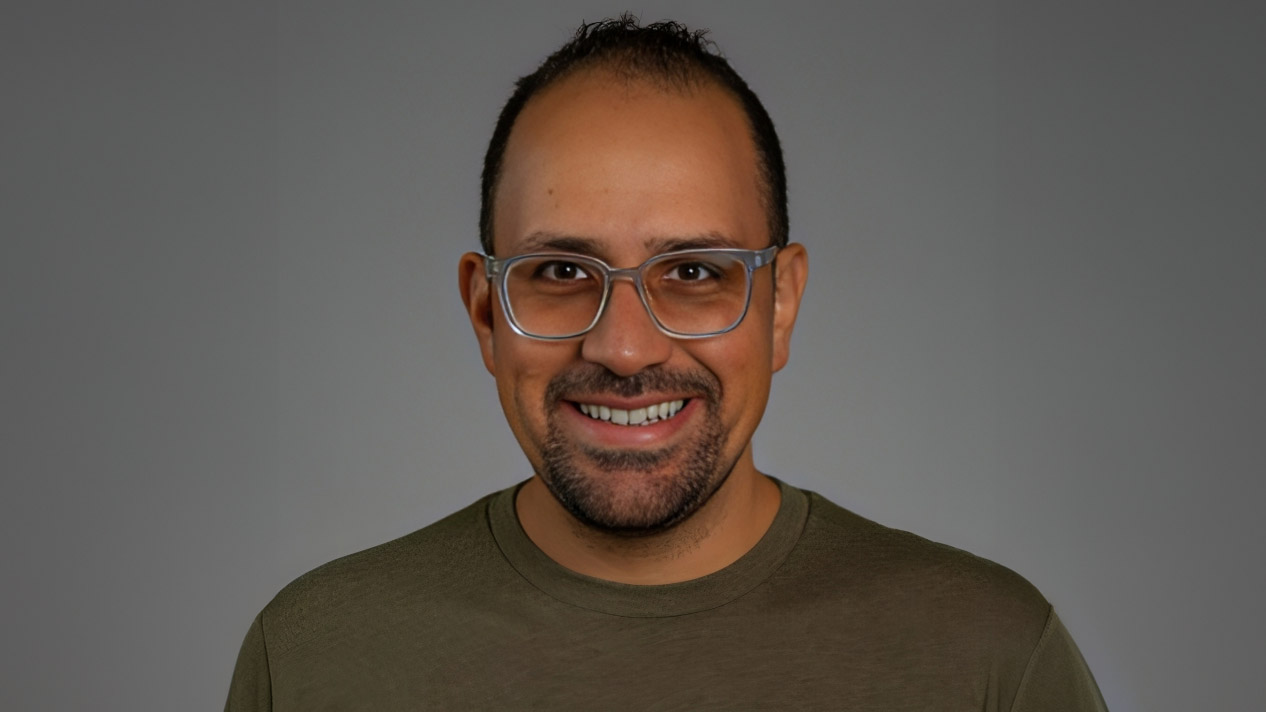

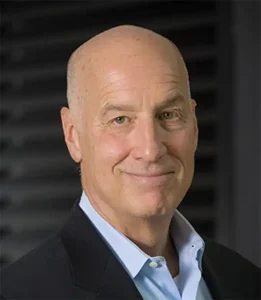

Mark Gaeto

6. Recurring Revenue Models and Strong Gross Margins

Recurring revenue models are a cornerstone of PE interest. They provide stable, predictable cash flows that support scalability and growth. However, recurring revenue alone isn’t enough. Investors also scrutinize gross margins to assess an MSP’s financial health and operational efficiency.

To stand out, MSPs should aim for:

- Gross margins of 40% or higher, with elite performers achieving 50% or more, depending on the service mix and specialization

- A clear understanding of margin contributors, including pricing strategy, vendor relationships, and efficient cost management

- Demonstrated profitability across service lines, especially for higher-value offerings like managed security, cloud services or vertical-specific solutions

PE investors value MSPs that can sustain high gross margins while maintaining strong annual recurring revenue (ARR), monthly recurring revenue (MRR), and retention rates. Healthy margins signal operational efficiency, scalability, and pricing power. These are key indicators of a company’s ability to thrive in a competitive environment.

7. Financial Transparency

A critical element in attracting PE investment is having well-prepared financials that support generally accepted accounting principles (GAAP). Accrual-based accounting provides a clear, accurate picture of the business and serves as a strategic tool for CEOs. This type of financial transparency streamlines the M&A process, reducing time spent on due diligence and improving valuation outcomes.

Mergers and Acquisitions for Scale

Private equity firms are driving mergers and acquisitions (M&A) in the MSP sector to create larger, more competitive platforms. For MSP owners, participating in these roll-up strategies offers opportunities to:

- Expand service offerings

- Achieve operational efficiency

- Access new customer bases

By aligning with the right investor or acquirer, you can position your business for sustained growth while achieving your financial and strategic goals.

Mark Gaeto is managing director of Falcon Capital Partners, an investment bank that guides MSPs through mergers and acquisitions. If you have questions about the rapidly evolving market, find Gaeto at mgaeto@falconllc.com.

Featured image: iStock