IT’S AN INTERESTING yet challenging time to be a channel pro. On one hand, there has never been greater demand for information technology and professional services. Work models continue to shift to hybrid and remote—thus creating entirely new networking, communications, and cybersecurity requirements.

Further, clouds, Internet of Things, artificial intelligence, machine learning, analytics, and automation are rapidly redefining the business landscape—and SMBs are in desperate need of expertise and guidance.

On the other hand, connecting all the technology dots en route to business value can prove incredibly difficult, especially given today’s backdrop of rapid technology change, geopolitical instability, supply chain disruptions, a post-pandemic workplace, and a teetering economy.

Despite these uncertainties, channel pros are generally optimistic about their own prospects for 2023, according to ChannelPro’s annual State of the Channel survey. Their optimism is tamped down somewhat from last year’s exuberance, however, by the recognition that a well-defined business strategy and an ability to cut costs are essential as budgets and margins are getting squeezed.

It’s a point that solution providers and MSPs are tuning into. As Daniel Velez, CEO of Suffern, N.Y.-based MSP Unique IT Pro puts it: “2023 will continue to be a strong financial year for the MSP space, with growth, mergers, and acquisitions. The challenge is finding proper tools and solutions in order to get the job done for clients at a fraction of the cost.”

It’s a point that solution providers and MSPs are tuning into. As Daniel Velez, CEO of Suffern, N.Y.-based MSP Unique IT Pro puts it: “2023 will continue to be a strong financial year for the MSP space, with growth, mergers, and acquisitions. The challenge is finding proper tools and solutions in order to get the job done for clients at a fraction of the cost.”

The Economic Outlook

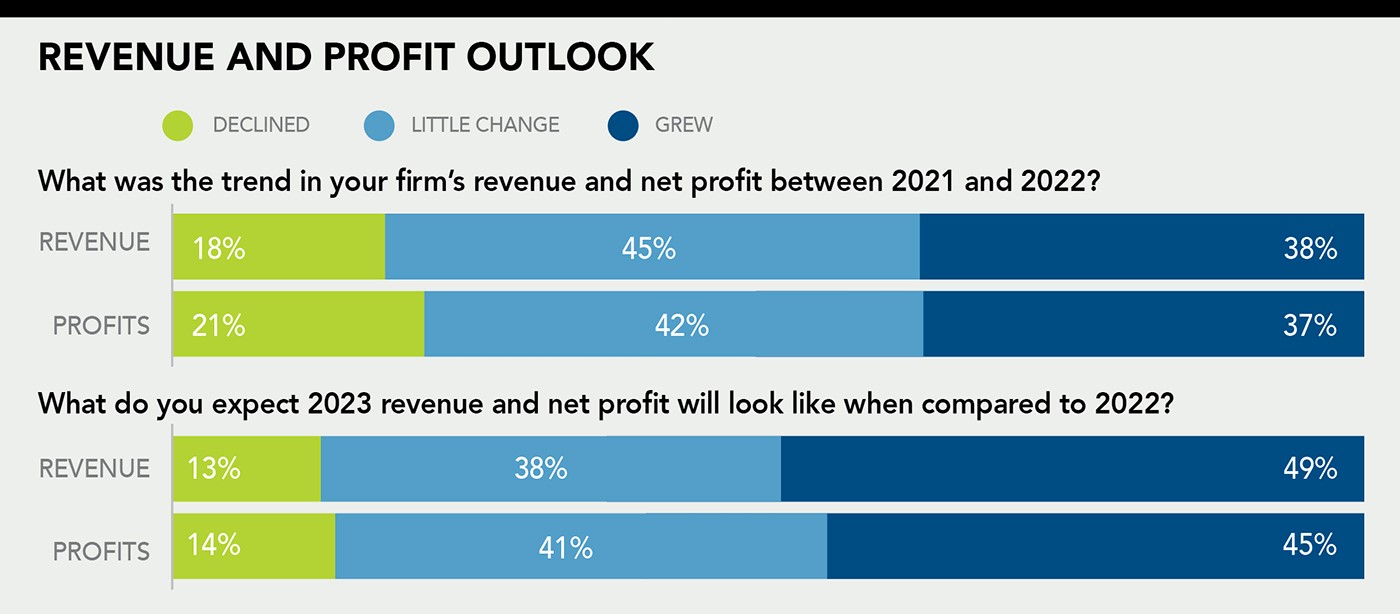

Revenue and profit growth slowed somewhat in 2022, but overall channel pros are still doing well. Last year, 38% of channel firms witnessed a rise in revenues, down slightly from the 40% who saw revenue growth in 2021, while 45% saw little change and only 18% witnessed a decline in revenues. Not surprisingly, profits tracked at nearly equal levels; 37% grew their bottom lines, down slightly from 42% the previous year.

It’s a trend that will likely continue. Altogether, 87% of respondents believe that revenues will remain stable or improve over the course of 2023. Just over half (52%) expect the number of employees to remain the same (again, up by about 8% from the previous year), while an impressive 43% are predicting a need to hire additional staff. Only 5% say that their employee count will likely drop.

This optimism extends to customer spending in the IT space, though again, it is somewhat tamped down from last year when 73% expected higher spending compared to 55% this year. One-third (32%) believe it will remain about the same in 2023 and just 13% predict a decline.

Channel pros are taking note of the impact of an uncertain economy. “We do see headwinds in 2023…so we are taking steps to enhance client retention while, counterintuitively, raising prices due to the level of inflation and general increase in operating costs,” says Wade Yeaman, CEO of Plano, Texas-based Fluid IT Services. The firm has responded to a more challenging business and economic environment by upping investments in marketing and sales in order to “aggressively target specific verticals or use cases.” It also has added to inventory levels to reduce supply chain risks.

Among survey respondents who have a vertical focus, the top service areas are manufacturing (69%), followed by healthcare and scientific (66%), legal/professional services (63%), insurance and financial (63%), and retail/hospitality (53%).

Channel pros are expecting growth in these vertical segments: eSports (84%), higher education (75%), K-12 education (72%), government (64%), transportation/logistics and energy (60%), insurance and financial (54%), and home/SOHO (53%), though their expectations for growth for their own firm serving companies in these verticals are much lower.

Opportunity Knocks in Both New and Traditional Areas

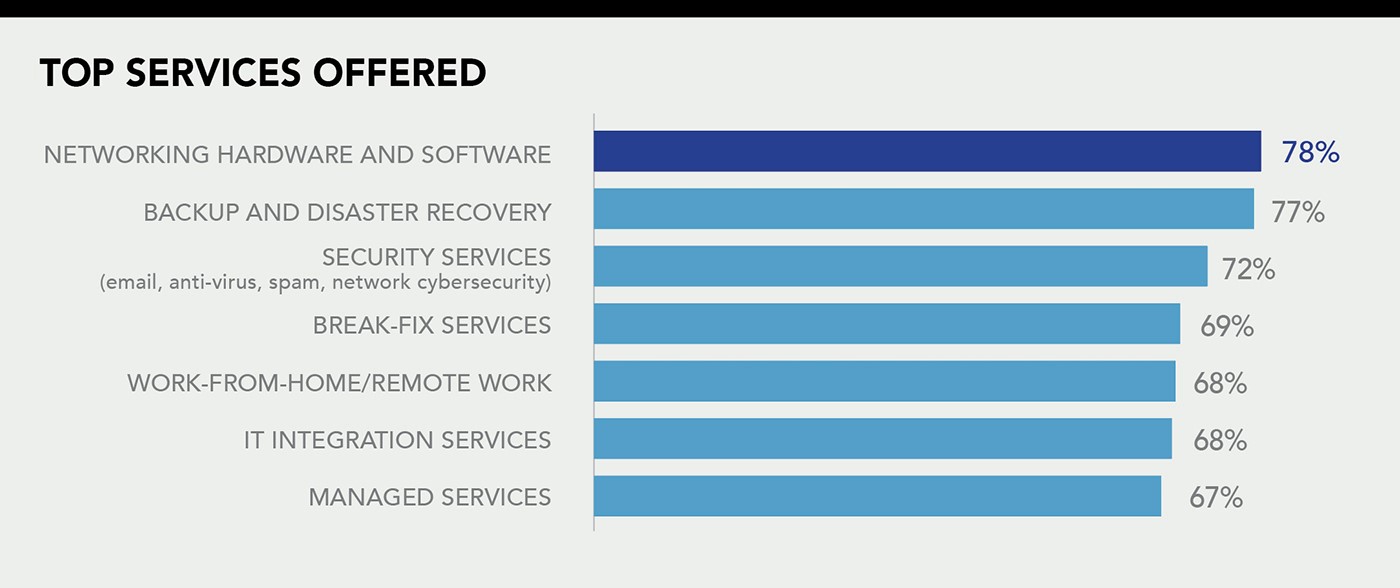

Channel firms continue to focus on a wide array of products and services. Leading areas include networking (78%), backup and disaster recovery (77%), security services (72%), break-fix services (69%), work from home/remote work connectivity (68%), IT integration services (68%), managed services (67%), and PCs and peripherals (66%).

Amid a shifting business and technology landscape, where do channel pros see the biggest future opportunities? Top answers include desktop virtualization (28%), training (26%), IoT (25%), custom app development (22%), biometrics associated with authentication services (22%), managed security (21%), cloud consulting/deployment/migration services (19%), and Google Apps licensing, videoconferencing, and analytics/big data (all also at 19%).

This should be taken as a positive sign. Many channel pros have recognized the need to shift their business focus away from traditional offerings to products and services with growing demand and often higher profit margins. For example, 34% anticipate higher profits for managed security in the year ahead, with 32% predicting the same for both cloud consulting/migration and security services, followed by managed services (30%) and work-from-home solutions (28%).

By contrast, 59% of respondents to our survey continue to see stable profit margins in the old-school networking hardware and software space while, 58% report little or no change in margins for PCs and peripherals, 56% in storage solutions, 56% in break-fix offerings, and 53% in backup and disaster recovering, including DRaaS.

The Managed Services Landscape

It’s no secret that the managed service space is expanding. A 2022 report from Precedence Research found that the global managed services market is growing by about 12.6% annually and it will reach US $757.1 billion by 2030.

Yet, many channel pros are struggling to make this transition. Last year’s survey found that 24% of respondents earned less than 10% of their annual revenues through managed services. That number jumped to 43% in this year’s results. And only 11% earn 75% or more of their top line through monthly recurring revenue, down slightly from 16% last year. What’s more, just 34% see their revenues increasing through managed services in the year ahead, while a resounding 61% expect it to remain the same.

At Avant-Garde-Technologies Corp., an Atlanta, Ga.-based MSP, CEO Albert Gustafson believes that a key to success in managed services is building a “platform” that supports various products and services, typically through the cloud. He is avoiding getting into a commodity business model—charging separate fees for every product and service—and instead working to build a more “holistic approach” that bundles offerings. “We want to deliver greater value,” he said.

Channel Pros Head into the Clouds

For firms offering cloud services, the top offerings at present include: security products and services such as backup and disaster recovery (68%), consulting (67%), anti-virus, spam filtering and EDR (65%), storage (63%), and networking and Wi-Fi (62%). Among the products and services channel pro firms are looking at adding, Infrastructure-as-a-Service (30%), Platform-as-a-Service (23%), cost optimization (21%), analytics (20%), managed hosting (19%), and data migration (19%) all scored high.

All of this supports the trend that many channel firms are shifting to the cloud. While only 9% currently earn 75% or more of their revenues through various cloud computing products and services, 39% fall into the range of 25% to 74% of their revenues deriving from managed cloud services. More telling is the fact that 40% see their share of cloud revenue growing in 2023. Only 3% said they expect their revenue from cloud services will decrease.

Cashing in on Security Needs

Another hot area is both managed and conventional cybersecurity offerings. It’s no secret that attacks are becoming increasingly sophisticated and outcomes—particularly from ransomware and data breaches—can prove devastating. News media headlines have reported multimillion-dollar ransoms, as well as the release of highly sensitive information. Many SMBs have few internal resources to build a strong defense.

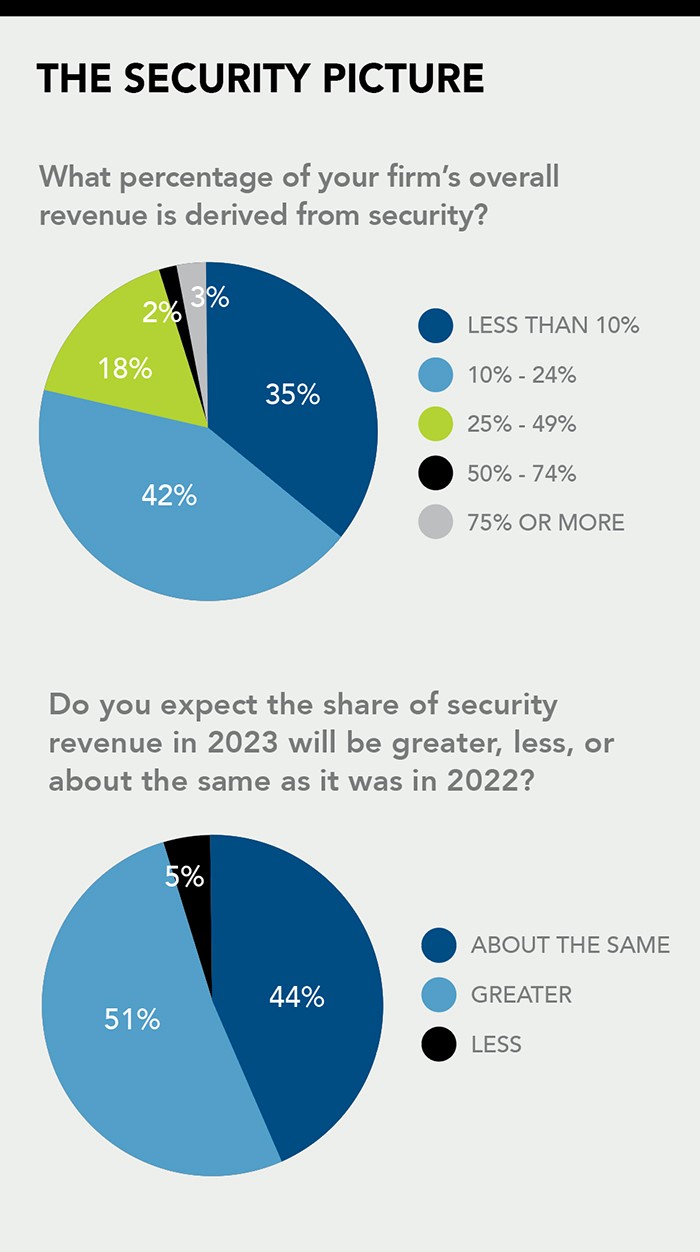

As a result, 51% of channel pros say they expect their security revenues to increase in 2023, and 44% believe revenues will hold steady. Moreover, 23% of polled firms say that half or more of their total revenues now derive from various security products and services. An additional 42% report that the revenue figure falls between 10% and 24%. The takeaway? Security is on everyone’s radar and savvy firms are cashing in. Indeed, managed security tops the list of high-margin offerings, according to 35% of respondents, up from 29% last year.

Looking Ahead

As more advanced digital technologies have emerged, there’s a fundamental need for organizations to build strategic planning assumptions into their business framework, according to Gartner. This includes a focus on things like technology, the economy, regulatory issues, and sustainability. It also includes a better understanding of value metrics rather than straight return on investment (ROI), and using AI and other tools to reduce carbon output.

What does this mean for channel pros? When we spoke to respondents about how they are approaching this environment, they indicated that upping the ante on knowledge, expertise, and acumen is important. It’s critical to become a trusted partner and thought leader, they noted. In addition, Gartner states that business leaders must also “sense and respond to disruptions and anticipate change” beyond conventional areas they are accustomed to focusing on.

Several companies we spoke to said that embracing AI and automation capabilities is important. “AI will be a major force in the tech world,” states Ali Johnston, president of Bel Tech Services, a Satellite Beach, Fla., firm. “The focus for my firm this year is learning as much as we can about AI and how I can use it to help my customers and improve workflows in my own business. I believe we have entered an era of rapid advancement that we haven’t seen since the introduction of the internet and the dot.com boom.”

At Unique IT Pro, Velez is doubling down on building the firm into a center of expertise. “We are challenging the team to master solutions and become certified so that we can stand out as leaders. Knowledge is power and I am pushing to empower my team so that we can grow into an elite company,” he explained.

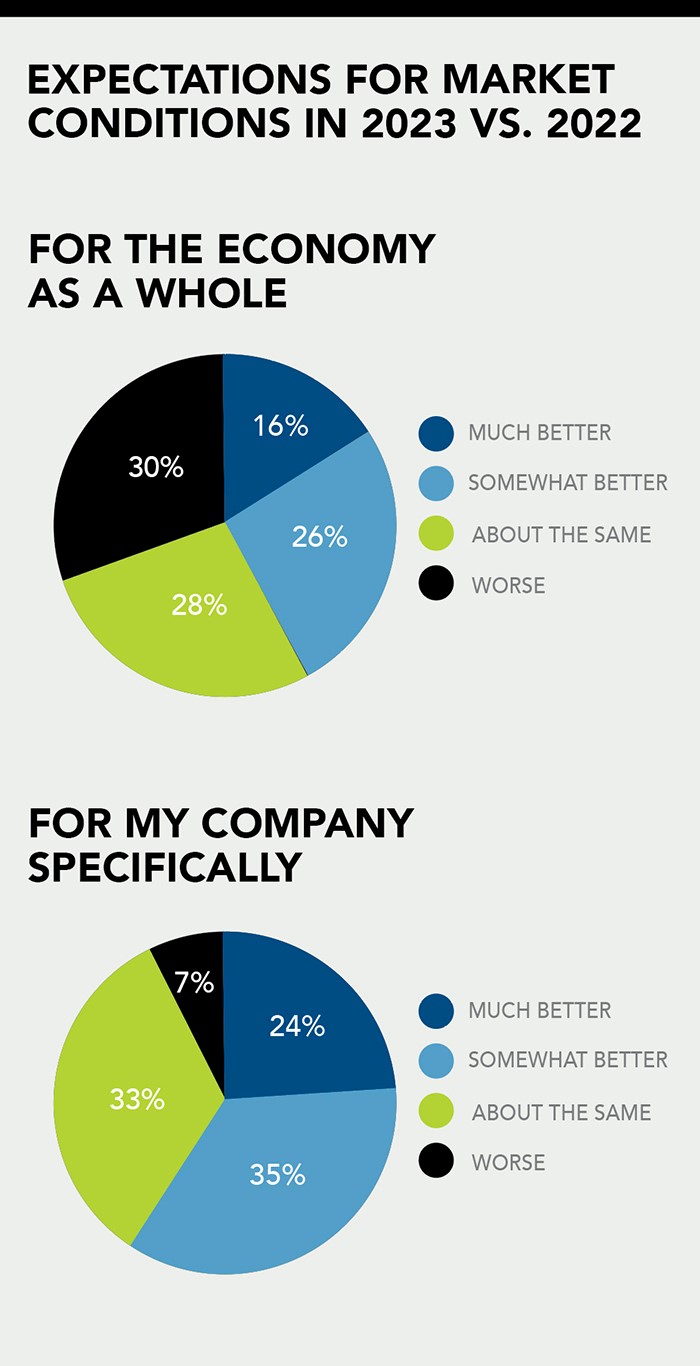

In the end, survey respondents remain upbeat about the future. While only 42% believe that the overall economy will improve in 2023, 53% think that channel pros will fare better, and 59% believe their company will outperform the industry.

Overall, 55% of firms expect customers to ramp up spending in 2023, which is down from 73% in 2022, while 13% believe that they will tighten the purse strings, up from 6% in last year’s survey. More than half of companies surveyed plan to keep company salaries and earnings the same, 76% have no plans to sell, buy, or merge their business, and only 8% are looking to buy a business. Moreover, only 25% plan to execute an exit strategy in the next one to three years.

Clearly, channel pros are navigating today’s turbulent marketplace and looking ahead. Says Yeaman at Fluid Services: “We are focused on new clients that share the same vision and value of technology as it relates to operating and growing a business. These win-win relationships will result in measurable mutual value in 2023.”

Methodology and Demographics

The annual ChannelPro State of the Channel survey queries leaders from managed service providers, VARs, system integrators, custom systems builders, and others, and offers broad insights into how business conditions are evolving and what firms should be focusing on.

The 2023 ChannelPro State of the Channel survey was conducted online from July to October 2022 and was open to everyone in our email database. About 56% of the 810 respondents are MSPs, 32% say they’re primarily VARs, and 21% are custom system builders. Forty-five percent hold executive management titles such as CEO, owner, and president; 17% work in unspecified technical management roles; and 14% are sales or marketing managers. Thirty-seven percent of respondents work at companies with one to four employees, while 20%, 31%, and 12%, respectively, are affiliated with firms that have five to nine, 10 to 49, and 50-plus people on staff. In addition, 49% of the firms surveyed have been in business more than 20 years, and 65% of respondents are aged 50 or older.

Get the full results of the 2023 State of the Channel Report here »

Get the full results of the 2023 State of the Channel Report here »