MSP Technology News Headlines for the week of 3/2/2026

Monjur’s new AI-Powered legal assistant for MSPs, Monjur Pilot, leads this week’s headlines of MSP interest, but Cato’s auto-adaptive threat prevention engine and a boatload of news tidbits, stories, reports, and insightful data from all over the industry should satisfy even the most critical channel news junky. If you’re ready for a quick rundown of this week’s MSP news and partner program updates, scroll on down!

Monjur Launches Monjur Pilot, a New AI-Powered Legal Assistant for Managed Service Providers With Built-In Attorney Supervision

New AI-powered legal assistant helps MSPs generate, review, and manage contracts with integrated attorney oversight.

Key quote from the press release:

“MSPs are under consistent pressure to close deals and deliver customer value, but hasty contractual decisions or missteps can lead to long-term legal and financial risks. Monjur Pilot combines the knowledge and oversight of experienced MSP attorneys with the speed, efficiency, and automation of AI-powered contracting intelligence, so MSPs no longer have to choose between slow, expensive contract attorneys and risky, DIY contract language generated by unsupervised LLMs.” — Rob Scott, CEO and co-founder, Monjur, Inc.

Cato Unveils World’s First Auto-Adaptive Threat Prevention Engine in a SASE Platform to Stop Attacks Before Compromise

Cato Dynamic Prevention proactively stops stealthy, multi-stage attacks by correlating long-term behavior in real time and automatically adapting security policies.

Key quote from the press release:

“Enterprises are already struggling to stop advanced threats that unfold quietly over time, and with the explosion of AI and autonomous agents, the threat landscape is accelerating exponentially. Threat actors abuse trusted tools and valid credentials, knowing most defenses still analyze isolated events and rely on humans to connect the dots for more complex attack chains. Cato Dynamic Prevention changes the game by continuously understanding behavior in context, predicting the threat actor’s next move, and enforcing protection automatically that would only impact true positive threats. As a result, this stops potential threats before a breach ever takes shape.” — Lior Cohen, vice president of product management, security and management, Cato Networks

Cork Cyber Launches Software Installer Scripts, Begins its Expansion to Continuous Risk Intelligence & Remediation

New capability within the Cork Vantage Platform enables MSPs to generate dynamic installer scripts for vulnerable and outdated software across Windows environments.

Key quote from the press release:

“We are no longer just admiring the problem, we are here to eliminate it. In January, we set the standard with the Cork Cyber Score. Now, we are shifting from scoring risk to actively crushing it. Cork is evolving into the Continuous Risk Intelligence & Remediation Platform for the MSP ecosystem. We built the operating system that directly aligns operational security performance with financial continuity, and we are doing it without requiring MSPs to deploy a single additional agent.” — Dan Candee, CEO, Cork Cyber

ConnectWise 2026 MSP Threat Report: Identity Abuse Is Redefining MSP Risk

New research highlights how attackers increasingly bypass traditional defenses by abusing trusted identities, automation, and user behavior.

Key findings from the report include:

- Attackers increasingly gain access by abusing trusted identities and credentials rather than exploiting software vulnerabilities.

- ClickFix-style social engineering attacks—where users are tricked into executing malicious commands—have emerged as a repeatable intrusion technique.

- AI is accelerating cybercrime by enabling deepfake fraud, AI-generated phishing campaigns, and automated malware development.

- Threat actors are using automation and legitimate tools to blend malicious activity with normal user behavior, making detection more difficult.

- Security teams must shift from reactive detection to earlier-stage defenses focused on identity, privilege, execution context, and resilience.

Sophos and Spektrum Labs Partner to Launch Insurability FastTrack Program with Sophos MDR

New program provides organizations with instant cyber insurance eligibility verification powered by Sophos MDR and Spektrum Labs.

Key quote from the press release:

“Our customers count on Sophos MDR to stop attacks before they cause real damage. By partnering with Spektrum, we take that a step further, delivering immediate, verifiable proof of insurance that reduces friction and accelerates trust with brokers, boards, and underwriters. Together, MDR and cyber insurance cost less and deliver more when they operate as one.” — Chris Bell, SVP of global channels, alliances, and corporate development, Sophos

MSP Well Launches as the IT Channel’s First Dedicated Mental Health Community

New nonprofit initiative aims to bring mental wellness resources, peer support, and open dialogue to IT professionals across the channel.

Key quote from the press release:

“After decades of working in the MSP space, I’ve seen firsthand the camaraderie that exists between IT and security professionals. This industry shows up for each other during breaches, outages and crises, but we don’t always show up for ourselves. MSPwell was born from the recognition that we need to better support the people who support all of us every day by keeping businesses secure. If we strengthen the wellbeing of the humans behind the keyboards, we strengthen the entire ecosystem.” — James Mignacca, co-founder, MSPwell

Cyolo Releases Powerful New Capabilities to Redefine Secure Remote Access for OT

New enhancements to the Cyolo PRO platform deliver deeper visibility, control, and collaboration for remote access across operational technology and cyber-physical systems.

Key quote from the press release:

“Industrial organizations are looking for a more comprehensive approach to access that lets them see and control what’s happening inside their OT network. Because Cyolo is purpose-built for CPS, we understand that securing these environments requires more than just protecting the point of access. With Version 7.0, we are extending visibility and control throughout the full session lifecycle, from asset awareness to automated session transcripts and simplified auditing.” — Almog Apirion, CEO and co-founder, Cyolo

Opollo Strengthens MSP Outreach with Propensity Partners Acquisition

Acquisition integrates inbound marketing and outbound lead generation to create a unified growth engine for MSPs and B2B technology firms.

Key quote from the press release:

“This is more than a merger; it’s the final piece in our long-term vision to deliver world-class digital marketing and lead generation as a single, unified service. With Propensity Partners now part of the Opollo fold, we’re eliminating silos and delivering high-end value to clients who want performance and strategy under one roof.” — Steven Morey, director, Opollo

IRONSCALES Launches Three AI Agents to Help Security Teams Outsmart Bad Actors and Agentic Cybercrime in the Era of Phishing 3.0

New agentic architecture introduces Red Teaming, Phishing SOC, and Phishing Simulation AI agents to help organizations shift from reactive to preemptive email security.

Key quote from the press release:

“Phishing 3.0 is flawless impersonation at scale. Attackers use AI to research organizations, craft personalized lures, and bypass pattern-based detection on the first attempt. No malicious payloads, just pure social engineering. Legacy solutions weren’t built for this. But our new agents enable the shift from reactive to preemptive email security, allowing CISOs and their teams to stay ahead.” — Eyal Benishti, CEO, IRONSCALES

Alkira Launches Connect Partner Program to Help Partners Solve Complex Networking and AI Infrastructure Challenges Faster, More Profitably, and Without Disruption

New partner initiative enables GSIs, MSPs, and cloud partners to scale high-margin services and accelerate AI-ready networking deployments.

Key quote from the press release:

“The philosophy behind Connect is that we win when our partners grow their own services revenue. We believe channel partners are evolving from resellers to growth partners, combining resale with high-value services. Connect is built so partners deliver outcomes plus services. It’s about giving them a repeatable engine to solve the ‘impossible’ networking hurdles that face every Fortune 500 company today.” — Doug Houghton, director of channels, Alkira

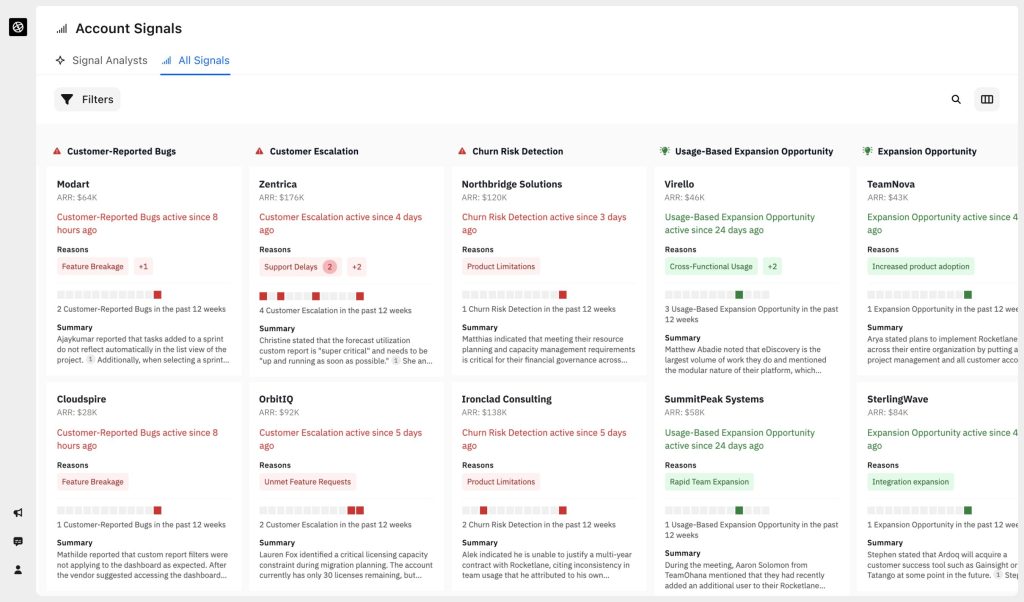

Rocketlane Launches Nitro, the Industry’s First Agentic Execution Platform for Professional Services

Nitro helps services teams deliver more projects with the same headcount — cutting delivery effort by up to 50% and surfacing risks weeks earlier.

Key quote from the press release:

“Professional services has never had a true execution engine. Traditional PS tools plan work, track work, measure work. Their AI assists with work around work. Nitro is the first AI platform to execute the work itself. This radically changes the risk and economics of services.” — Srikrishnan Ganesan, CEO, Rocketlane

Keeper Security Launches Native Jira Integrations to Unify Security Incident Response and Privileged Access Governance

New integrations connect security alerts, access requests and approvals into a single governed workflow while keeping enforcement centralized in Keeper.

Key quote from the press release:

“Security teams don’t just investigate incidents in Jira; they also coordinate the access changes required to resolve them. This industry-first integration extends privileged access approvals and workflow into the tools that security and IT teams use every day, ensuring that strict encryption controls are still in place.” — Craig Lurey, CTO and co-founder, Keeper Security

Rewarding Value Through the New Salesforce Partner Program

Salesforce updates its partner program to prioritize verifiable customer outcomes, simplified tiers, and specialized competencies for the agentic AI era.

Key quote from the press release:

“Specialization is the new currency of the agentic era. By streamlining our competencies, we ensure our customers can find the right expert at the right time to turn complex AI potential into a trusted competitive advantage.” — Nick Johnston, SVP, global consulting partners & partner sales, Salesforce

Nutanix Enterprise Cloud Index Finds AI Is Driving Rapid Container Adoption

Eighth annual Enterprise Cloud Index report highlights how AI adoption is accelerating infrastructure modernization while shadow IT and organizational silos create new risks.

Key findings from the report include:

- 85% of respondents say AI is accelerating their adoption of containers to improve speed, reliability, and scalability.

- 87% expect the use of containers for applications to increase over the next three years, while 83% say they are already building new applications in containers.

- 82% believe silos between business units and IT make it harder to execute technology initiatives and increase operational complexity.

- 79% report encountering AI applications or agents deployed outside IT oversight, and 87% believe such unauthorized AI use introduces risk.

Distribution: The Digital Force Multiplier

GTDC research report examines how IT distribution is evolving to support cloud, AI, hyperscaler, and platform-driven channel models

Key findings from the report include:

- 80% of vendor executives rank partner ecosystem growth as the most important distribution value-add to their go-to-market success.

- 57% cite sales enablement resources from distributors as critical for educating partners and supporting cloud and AI-driven solutions.

- 86% of suppliers are either using a digital distribution platform today or actively evaluating options to support transactions, lifecycle management, and analytics.

- 60% of vendors maintain direct relationships with hyperscalers, while 40% leverage both direct and distributor-supported models.

Forcepoint Secures AI Adoption and Data Everywhere with New ARIA AI Assistant and Endpoint Intelligence

Revamped partner program aligns incentives and enablement around Forcepoint’s Data Security Cloud to help partners scale modern data security deployments

Key quote from the press release:

“AI has made data a living, breathing thing, permanently changing how information ripples through organizations and demanding true visibility and control that moves just as fast. By embedding ARIA directly into Data Security Cloud, we’re helping security teams respond faster to emerging threats and strengthen adaptive protection across modern environments. Our enhanced partner ecosystem is how we bring Self-Aware Data Security to life at scale.” — Ryan Windham, CEO, Forcepoint

As ChannelPro’s online director and tech editor for over a decade, Matt Whitlock has spent years blending sharp tech insight with digital know-how. He brings more than 25 years’ experience working in the technology industry to his reviews, analysis, and general musings about all things gadget and gear.

Images: Connectwise, Opollo, Alkira, Rocketlane, Salesforce, GTDC