March 11, 2020 08:30 AM Eastern Daylight Time

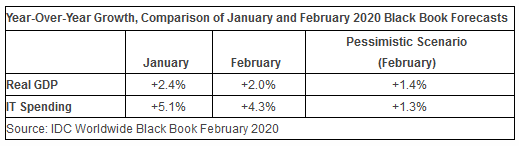

FRAMINGHAM, Mass.–(BUSINESS WIRE)–The escalating coronavirus crisis is already impacting IT markets as buyers and vendors adjust to a new set of assumptions and a new global economic reality. Based on data indicators in the first quarter, International Data Corporation (IDC) expects to see a significant slowdown in spending on hardware in particular during the first half of 2020 with software and services spending also affected as the crisis reverberates through all sectors of the economy, including supply chains, trade, and business planning. By the end of 2020, in a pessimistic scenario, IT spending could grow by 1% compared to the original forecast of more than 4% growth, and these forecasts are more likely to trend down than up in the next few weeks.

IDC expects to see a significant slowdown in spending on hardware during the first half of 2020 with software and services spending also affected as the coronavirus crisis reverberates through all sectors of the econ

According to the IDC Worldwide Black Book Live Edition for February 2020, IT spending is projected to grow by 4.3% in constant currency terms this year, reflecting downward adjustments to forecasts for hardware device sales. This is down from the 5% forecast in January, and IDC expects the March Black Book to show an additional downgrade to these forecasts based on the latest indicators and survey data, and the escalating situation in other regions outside China.

“The situation is extremely fluid,” said Stephen Minton, vice president in IDC’s Customer Insights & Analysis group. “Our monthly data and surveys are clearly pointing in one direction, but it’s still early to understand the full impact of the coronavirus crisis across all sectors of the economy. We are using scenario models to illustrate that forecasts have a wider range than usual, and the downside risks in those models seem to be increasing every day. But the duration of the crisis remains a big unknown and will go a long way in determining overall market growth for the year as a whole.”

Worldwide IT spending was originally forecast to grow by just over 5% in constant currency this year, as strong PC sales in the fourth quarter of 2019 gave way to a smartphone upgrade cycle driven by 5G and a recovery for service provider spending on infrastructure, while momentum around digital transformation projects continued to ensure strong demand for software and IT services. The February Black Book downgraded growth to 4.3% and this is likely to drop closer to 3% in March based on the latest forecast adjustments and scenarios. In a pessimistic scenario, based on the crisis extending beyond Q2 outside China, the worldwide IT market is more likely to grow by around 1%.

Note: IT spending growth in constant currency.

“The pessimistic scenario is not a worst-case scenario,” added Minton. “Things are moving so quickly that we need to constantly recalibrate our assumptions and expectations, but the pessimistic scenario reflects an IT market in which weaker economic growth translates into weaker business and consumer spending across all technologies over the next few quarters. Things could get worse, but hopefully not.”

The Worldwide Black Book Live Edition is updated monthly with the latest IT spending forecasts for annual growth across 100 countries. It will continue to evolve and capture the escalating impact of the coronavirus on market expectations and will be published alongside a “pessimistic scenario” for IT spending for as long as the crisis persists. The pessimistic scenario can be used to understand the potential impact of the crisis beyond current actual data indicators for GDP and IT markets.

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading tech media, data and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights: http://bit.ly/IDCBlog_Subscribe.

Contacts

Stephen Minton

sminton@idc.com

+44 7435 753922

Michael Shirer

press@id.com

508-935-4200